How Long After Repayment is Issued from HMRC?

Tax overpayments are not uncommon in the UK. Each year, millions of individuals and businesses end up paying more tax than they owe whether through PAYE, Self Assessment, VAT, or Corporation Tax.

When HMRC acknowledges this overpayment, they initiate a refund process. But the question remains: How long after repayment is issued from HMRC will the money actually arrive in your account?

This guide provides a complete breakdown of HMRC’s tax repayment procedures, timelines, reasons for delays, and what actions you can take if your repayment hasn’t arrived when expected.

What Is the HMRC Repayment Process?

A tax repayment is essentially a refund of the money you’ve paid in excess to HMRC. Overpayments may arise from various situations.

For instance, you might be issued the wrong tax code, leave employment before the end of the tax year, or claim tax reliefs or expense deductions not initially factored into your tax liability. Similarly, businesses can overpay VAT or Corporation Tax.

Once you submit a tax return either under PAYE or Self Assessment HMRC determines whether you are entitled to a refund. If no debts or pending liabilities are attached to your tax account, the repayment process begins.

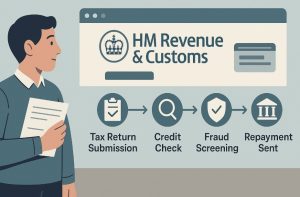

The steps involved in HMRC’s repayment system typically include:

- Initial Verification: HMRC reviews your submission for accuracy and compares it with their internal data.

- Credit Assessment: The system checks your account for any outstanding amounts or liabilities that could be offset against your overpayment.

- Security and Fraud Screening: High-risk claims, such as those involving large refunds or updated bank details, are flagged for additional checks.

- Repayment Method Confirmation: The refund is prepared and sent through the appropriate channel bank transfer (BACS), card refund, or cheque.

In simple PAYE cases, the repayment is often processed automatically. However, in more complex cases like VAT reclaims, Corporation Tax, or R&D tax credit claims, the process may require additional documentation and manual review by HMRC officers.

How Does HMRC’s Tax Repayment System Work?

HMRC’s tax repayment system relies on a combination of automation and human oversight. While many standard refunds are approved and sent out without intervention, the system is designed to identify anomalies that may warrant further investigation.

A simplified overview of the repayment process is as follows:

- Return or claim submission: The individual or business submits a tax return showing an overpayment.

- Account assessment: HMRC checks if there is a credit due and ensures there are no other liabilities.

- Risk analysis: If the claim is standard and poses minimal risk, it is passed for automated approval. If anomalies are detected, a manual review is triggered.

- Repayment preparation: The refund is drafted, verified, and authorised for release.

- Payment processing: The authorised amount is sent using the specified method, usually a BACS transfer for online claims.

If multiple tax returns for different years are filed simultaneously, HMRC generally processes the earliest return first. Any potential repayment will be calculated after deducting liabilities from each year sequentially.

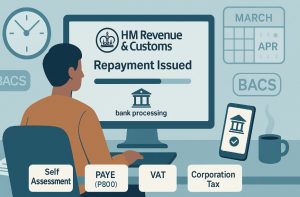

What Does “Repayment Issued” Mean on Your HMRC Account?

Seeing the status “Repayment Issued” in your HMRC account signifies that the repayment has passed all checks and has been dispatched to the payment system.

However, many individuals misinterpret this as meaning the funds are immediately available in their bank account.

In reality, the repayment is now in the transmission stage, meaning it has been released but not yet received. This stage includes processing by the relevant financial network typically BACS for bank transfers.

Depending on the chosen method, funds may take a few days or several weeks to reach you.

Timeframes based on repayment method:

| Method of Payment | Expected Timeframe |

| Bank Transfer (BACS) | 3 to 5 working days |

| Credit/Debit Card Refund | Up to 5 working days |

| Cheque (Postal) | 2 to 8 weeks |

| P800 Online Claim | Within 5 working days |

| P800 Default Cheque | Up to 60 days |

The time it takes for the repayment to land in your account also depends on weekends, public holidays, and the processing time of your bank.

What Is “Bank Repayment Pending”?

“Bank repayment pending” is another key status in HMRC’s refund system. It usually appears before the “Repayment Issued” status and means that HMRC is preparing the funds for transfer but hasn’t yet completed the transaction.

This phase can be short, lasting a day or two, but in certain scenarios it can extend up to a week or longer. Reasons for prolonged pending status include:

- Updates to your bank account information

- Unusually large repayment amounts

- System flags based on your tax return’s risk profile

- Fraud prevention reviews

If this status remains unchanged for more than 10 working days, it’s advisable to get in touch with HMRC to investigate further.

How Long Does HMRC Take to Issue a Tax Refund?

There is no fixed timeline for every refund, as the duration varies by tax type, return method, and complexity of the claim. While many repayments are processed within 5 working days after the “repayment issued” status, delays can occur.

Here is a breakdown of typical refund timeframes:

| Tax Type | Submission Method | Typical Time After Issued |

| Self Assessment | Online | 3–5 working days |

| Self Assessment | Paper | Up to 10 working days |

| PAYE (P800 Online) | Online Claim | Within 5 working days |

| PAYE (P800 Cheque) | Cheque | 2 to 8 weeks |

| VAT Refund | Digital Submission | 10 to 30 days |

| Corporation Tax Refund | Online | 4 to 6 weeks |

| R&D Tax Credit | Online | 4 to 8 weeks |

| Student Loan Overpayments | Via SLC | 4 to 6 weeks |

| National Insurance Refunds | Manual Request | 6 to 12 weeks |

What Causes Delays in HMRC Repayments?

Several factors can lead to delays even after HMRC has issued your repayment. Understanding these can help you avoid or resolve issues more effectively.

Common delay triggers include:

- Fraud prevention checks: High-value claims, new bank account details, or irregular filing patterns are often flagged.

- Manual intervention: Complex cases or those requiring additional verification are handled manually, which takes more time.

- Banking errors: Incorrect account numbers or sort codes may cause failed transactions.

- Tax payment holdbacks: Recent or pending payments may cause HMRC to delay refunds to prevent fraud.

- Peak periods: January (Self Assessment deadline) and April (end of the tax year) are high-volume times, slowing down processing.

- Voluntary returns: Returns submitted outside the typical filing window may not be prioritised.

How Can You Speed Up Your HMRC Repayment?

While HMRC ultimately controls the refund release, certain actions on your part can help prevent delays:

- Submit your tax return as early as possible, preferably before peak periods.

- Always provide correct and updated banking and personal details.

- File returns online using the Government Gateway, which is typically faster and more secure than paper submissions.

- Monitor your HMRC account regularly for updates or correspondence.

- Avoid changing bank details shortly before or after filing your return, as this often triggers verification procedures.

What Are the Different Types of HMRC Repayments?

Understanding the type of repayment you’re due helps manage expectations around processing times and potential delays.

- Self Assessment: Refunds typically take 3 to 10 working days. Delays are possible if voluntary returns are filed or the data contains discrepancies.

- PAYE (P800): Online claims are faster, but cheque-based repayments can take up to 2 months.

- VAT Refunds: Businesses claiming VAT refunds may receive them in 10 to 30 days. Larger claims may be audited.

- Corporation Tax: Repayments may be due if tax was overpaid based on estimated profits. Standard refunds take 4 to 6 weeks, while R&D tax credits can take longer if documents are incomplete.

- CIS Refunds: Common among subcontractors who have tax deducted at source. These are usually processed like Self Assessment refunds.

- Student Loan Overpayments: Typically handled via the Student Loans Company, these refunds take 4 to 6 weeks.

- National Insurance Overpayments: Occurs when individuals work multiple jobs or switch employment types. Manual claims can take up to 12 weeks.

When Can You Expect Your Tax Refund from HMRC?

To summarise, once HMRC issues a repayment, you can usually expect:

- Bank transfers: 3 to 5 working days

- Card refunds: Up to 5 working days

- Cheques: 2 to 8 weeks, depending on processing and postal delays

- P800 refunds (online): Within 5 working days

- P800 refunds (cheque): Up to 60 days if not claimed online

It’s always a good idea to check your HMRC account regularly and follow up if your refund is significantly delayed.

Frequently Asked Questions About HMRC Repayments

How do I check if HMRC has issued my refund?

Log into your HMRC account online and review your tax return status. A “repayment issued” message confirms it has been sent.

What should I do if my refund is taking longer than expected?

If it’s been more than 10 working days since repayment was issued, contact HMRC with your UTR or reference number.

Why does my repayment still show as pending?

This could be due to bank detail changes, system backlogs, or manual checks for fraud prevention.

Can I get my repayment quicker by calling HMRC?

Calling won’t speed up processing but can help identify issues. Only call after the expected processing window has passed.

Do cheques take longer than bank transfers?

Yes, postal cheques are slower due to handling, printing, and delivery times. Online bank payments are significantly quicker.

Is there a way to avoid fraud checks?

No, but submitting accurate information, using consistent bank details, and avoiding last-minute changes reduce the chances of being flagged.

Should I hire an accountant for my tax rebate?

For complex cases such as R&D claims, Corporation Tax overpayments, or disputes, using a professional can improve accuracy and reduce delays.